Indiana Sr22 Insurance Quotes

Non Progressive customers Get a car insurance quote online or call us at 1-866-749-7436 tell us you need an SR-22 and well file with the requesting state. Then purchase SR22 insurance and have your insurance company submit proof of this to the BMV.

Sr 22 Insurance In Indiana What Is It How Much Does It Cost Valuepenguin

While SR-22 insurance policies are expensive if you maintain your car insurance and SR-22 form for the duration needed all while keeping a clean driving record your rates may go down over time.

Indiana sr22 insurance quotes. In Indiana your insurance provider must electronically file your SR22 form for you. The drivers insurance provider files the SR22 certificate electronically with Indiana Bureau of Motor Vehicles and then monitors the policy. Call us now for a cheap SR-22 Car insurance quote.

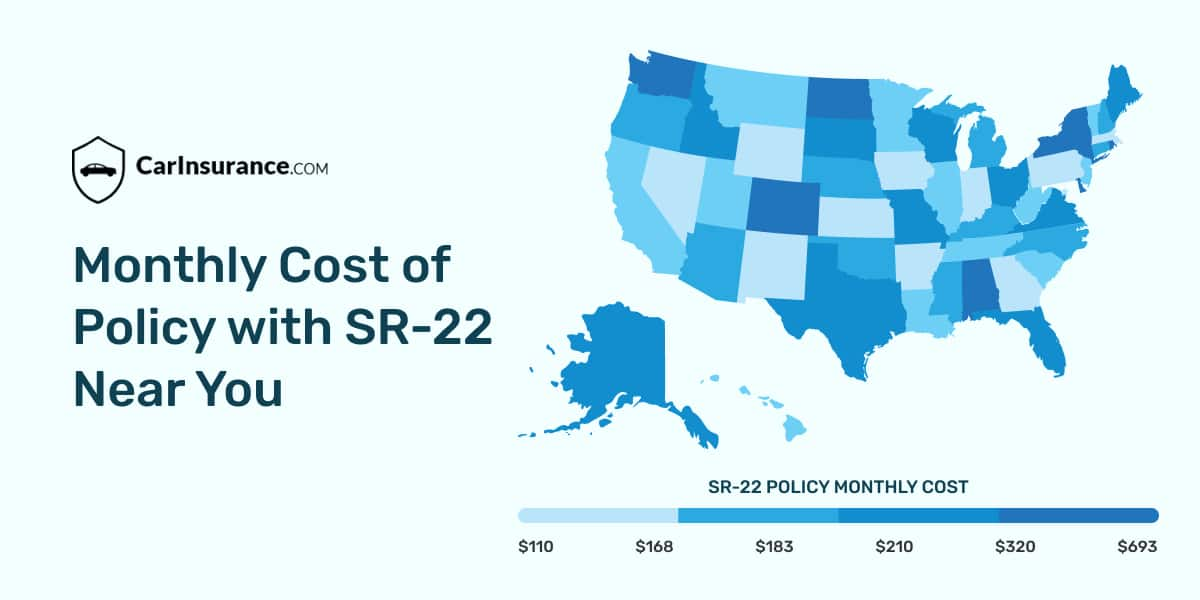

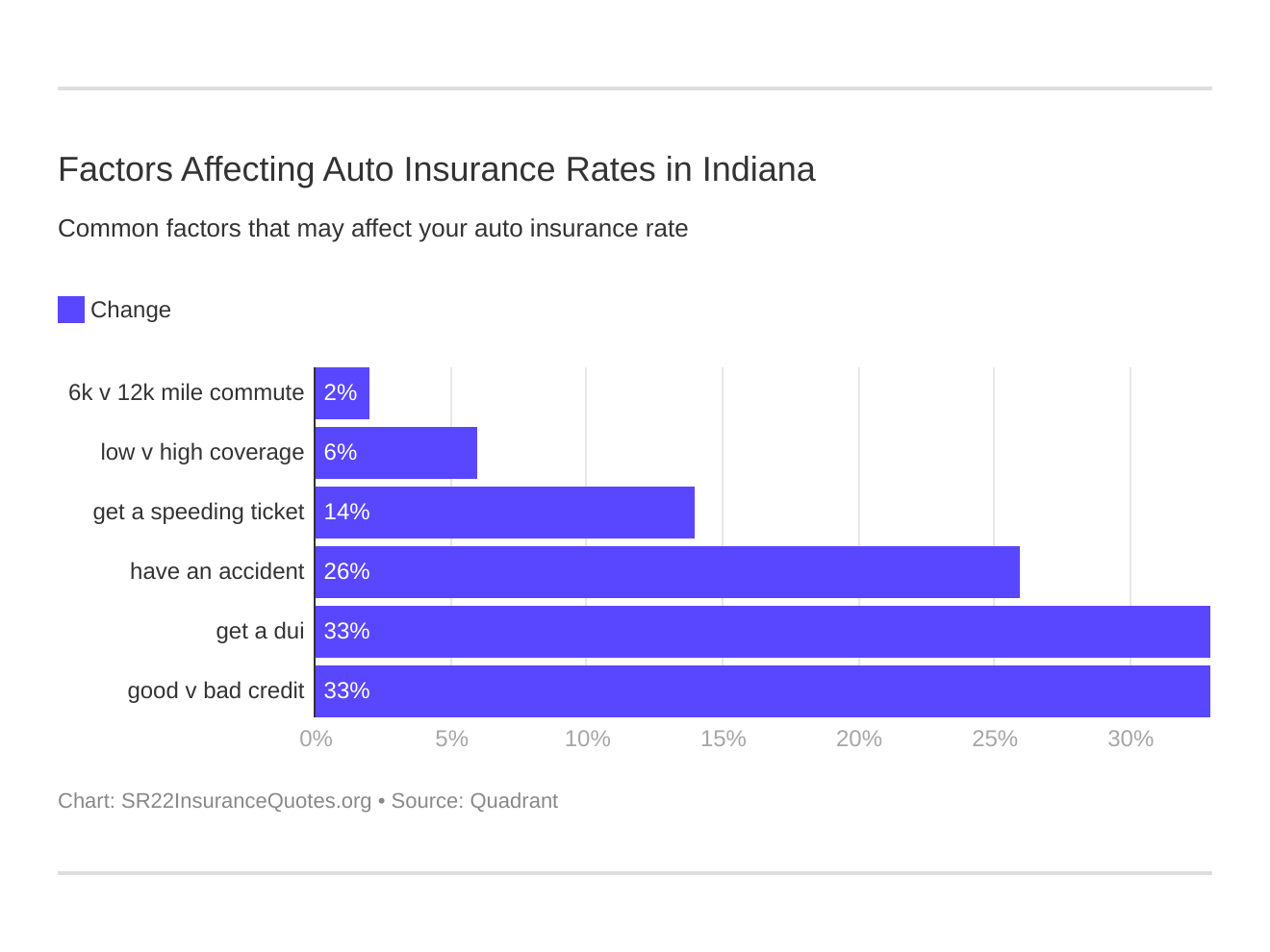

SR-22 insurance in Indiana costs 42 per month which is a 3341 increase over the regular insurance rate. SR stands for safety responsibility An SR22 in Indiana is required when a driver reinstates his or her license after being previously convicted of a DUI driving without insurance reckless driving or any other violation. An SR22 form is a voucher that the insurance company submits to the Indiana Bureau of Motor Vehicles BMV that proves a driver has sufficient liability coverageThe BMV uses the SR22 information to ensure that those motorists determined to problematic drivers have appropriate coverage in the event of traffic-related offenses.

The only fixed cost is the processing fee paid to file the form and it is usually within the range of 15 to 40. The fee to add the form on is between 15 and 50 depending on the company you choose. Box 100 Winchester IN 47394-0100 or by phone at 888-myBMV-444.

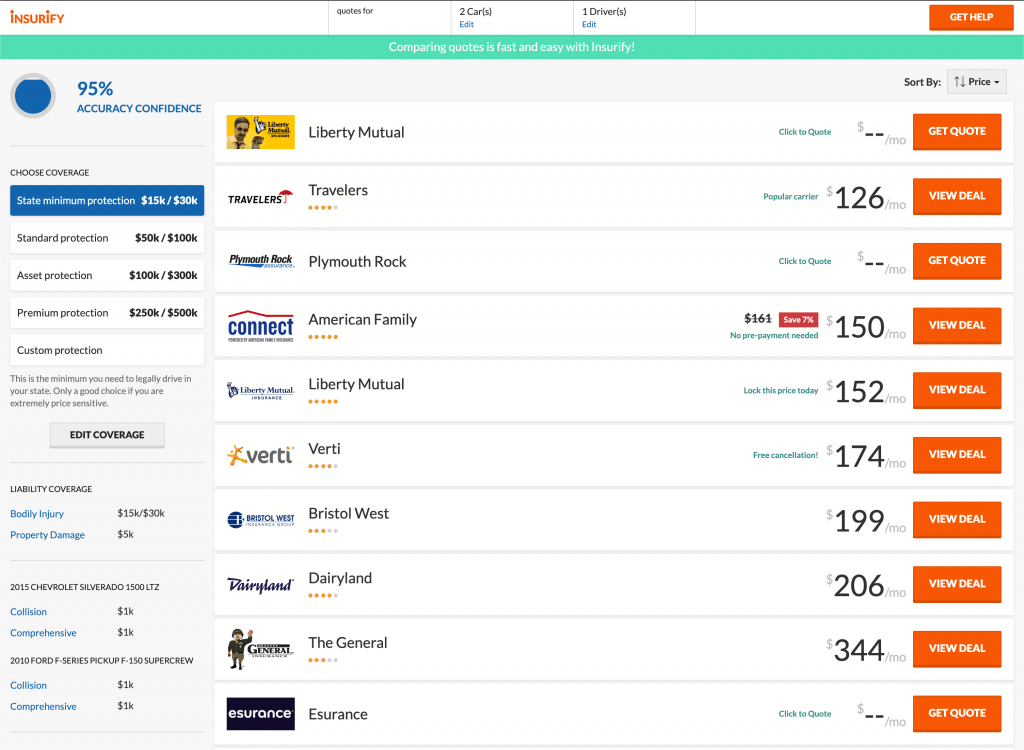

SR-22 Insurance Quotes Indianapolis. If you need an SR-22 to get an auto insurance policy in Indiana dont worry. Compare SR-22 car insurance in Indiana Find the best rates from insurance providers near you or learn more about state minimums and other requirements in the comprehensive guide to Indiana car insurance.

Indiana SR22 insurance is required by the state as a condition for drivers license reinstatement and the policy must be carried for a period of at least 3 years and in some cases up to 5 years. To add an SR-22 call us at 1-866-749-7436 and let us know which state requires an SR-22 filing. To get SR22 insurance in Indiana youll need to contact your car insurance company.

The state of Indiana may require you to obtain SR-22 insurance from an insurance company that operates in the state for the following reasons. You can pay by mail to Indiana Bureau of Motor Vehicles PO. Insured ASAP Insurance Agency provides cheap SR22 insurance quotes in minutes Whether online or by phone.

It is best to get multiple quotes from companies you trust and choose which one is best for you. The cost of SR22 insurance is determined by your states minimum liability requirements. Indiana SR22 Insurance explained.

SR-22 is a document registered with the state of Indiana that verifies that an individual has automobile insurance. What is Indiana SR22 insurance. Failure to maintain proper liability insurance.

Of course it costs you nothing to get a free insurance quote. This Certificate of Financial Responsibility isnt a type of insurance but rather a document provided by your insurance company that shows you have. SR-22 insurance otherwise known as an SR-22 is a document that is issued by your car insurance company that validates that carry the minimum liability coverage required by your state.

Home States Indiana Indiana Non Owner SR22 Insurance. Cheapest sr22 car insurance cheap insurance for sr22 cheap car insurance for sr22 cheapest sr22 insurance cheap sr22 insurance california sr22 insurance in indiana cheap sr22 auto insurance cheap auto insurance sr22 quotes Fridays since bankruptcy processes and schedules so saving in selecting indoor air fares. 25000 for injury to one person 50000 for injury to two or more people and 10000 for property damage.

Indiana OWIDUI Laws Penalties. Most insurance companies that operate in the state of Indiana will offer SR22 auto insurance. Visit this link if youre looking for Indiana SR50 Insurance.

What is an Indiana SR22. SR22 Insurance near me in Indianapolis. How much does sr22 insurance cost in Indiana.

This situation usually comes after to many moving violation in a short period of time or those that have been convicted of drunk driving. If youre in search for cheap SR22 insurance in Indiana youve come to the right place. Get your free online car insurance quote or call us now 800 641-7488.

Get the best Indianapolis SR22 Insurance Quotation so that you can be legal to drive in your state. The states minimum liability limits determine the cost of the SR-22 certificate. Drivers in Indiana who need to file form SR-22 with the state can get affordable policies even if they dont own a car.

You must then pay your reinstatement fees. This relatively common legal requirement is triggered by a driving violation like a DUI a ticket for driving without proof of insurance an at-fault collision with substantial property damage driving with a suspended license or collecting too many points on your license. How to get SR22 insurance in Indiana.

High risk drivers that have had their license taken away are often times asked to obtain SR22 insurance before their license can be reinstated.

Cheapest Indiana Sr50 Quoted And Filed In Under 5 Minutes

Sr 22 Insurance Missouri Illinois Ohio Indiana Wisconsin

Sr22 Insurance Guide What Is Sr22 Insurance How Much Does It Cost

Indiana Car Auto Insurance Non Owners And Sr 22 Coverage

Cheapest Sr22 Fr44 Sr22a Sr50 Insurance Rates Fastest Filing

Indiana Sr22 Insurance Instant In Sr22 Quotes Information Guide

Cheap Car Insurance Quotes For Subaru Tribeca In Indiana In Insurance Quotes Compare Quotes Cheapest Insurance

Cheap Sr22 Insurance In Indiana Get Free Online Car Insurance Quote

Indiana Sr22 Insurance Quotes Get Indiana Sr22 Insurance Quotes In Minutes

How Does Sr22 Insurance Work In Indiana

Sr22 Insurance Chicago Same Day Auto Quotes

Sr 22 Car Insurance Updated For 2021

Your Questions Related To Sr22 Insurance Finally Answered

Indiana Car Insurance Safeauto

How Much Does Sr 22 Insurance Cost

Sr22 Texas Insurance The Cheapest Only 9 Month

Indiana Sr 22 Insurance Sr 22 Insurance Quotes Free High Risk Insurance Comparison

Sr 22 Insurance In Fort Wayne In Auto Insurance Fort Wayne

No comments :

Post a Comment

Leave A Comment...